Comparison of programmes & important parameters to consider

When it comes to choosing a residency by investment programme in Europe or elsewhere, the choice becomes perplexing as the array of offers is quite wide.

To be sure, all available options offer the potential resident a variety of benefits. Among those, the possibility to live in the country of his choice, employment rights, access to health and education systems, inclusion of family members, travel to several countries without visa requirements and more.

In this article we will unfold the main questions that need to be answered by the applicants during the selection process of a residency by investment programme. We will also present the main features of the major European residency programs and how they compare to each other.

Different countries have different laws, currencies, terminology for legal or other required documents. The selection process can be very challenging for the potential investor/resident. Let us see which are the main points for consideration :

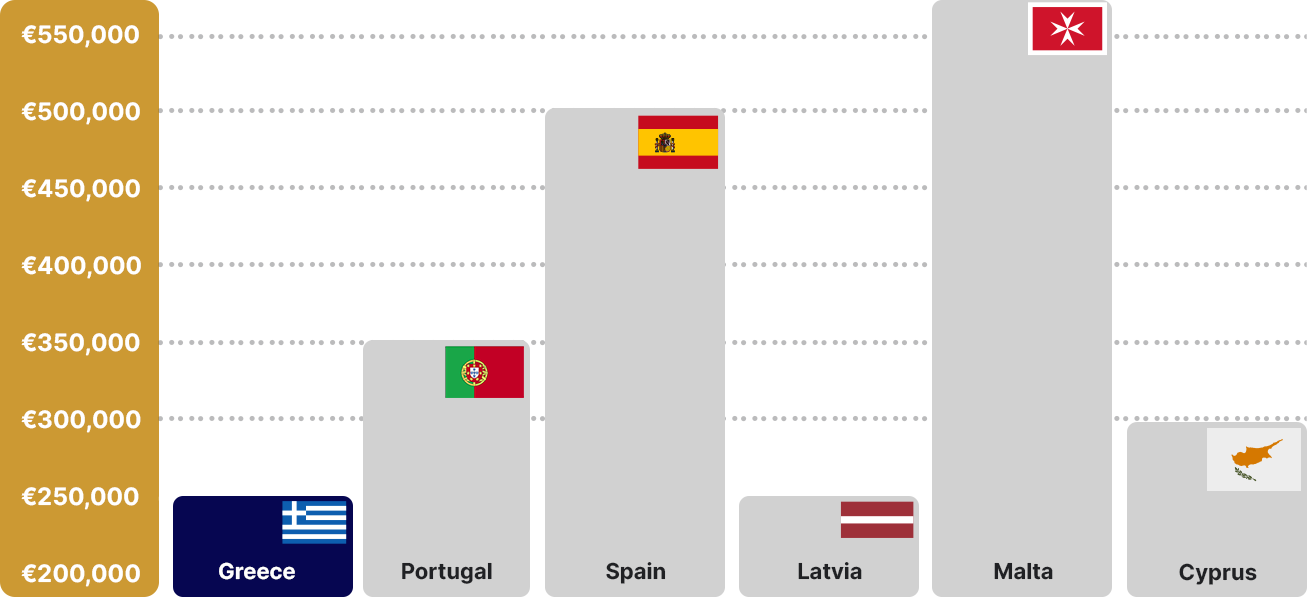

1. Total Cost of the initial investment

As a rule, there is a basic requirement on the part of the potential investor to invest in real estate or government bonds. On top of that, as well as government expenses, stamp duties, vouchers and various others amounts, the sum of which forms the total cost of the investment.

The services are offered by local companies specializing in the investment immigration business. They are mainly facilitators who know exactly what is required and how to do it. They are backed up by teams of lawyers, accountants, engineers and other required professionals who coordinate in order to complete speedily the residency project.

When you evaluate one or more residency programmes, make sure that you know the total cost from the very beginning. Ask your service provider to estimate it with precision and then guarantee that there will not be hidden charges at the end.

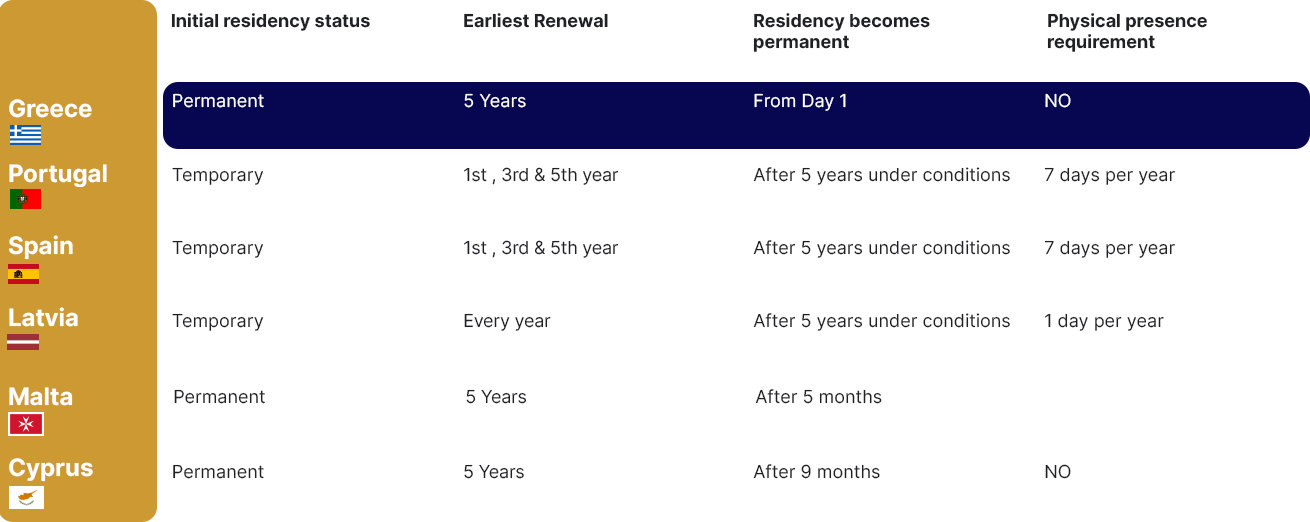

2. Requirement of physical presence & status of initial residency permit

Some countries, as part of the residency permit, require from the resident/investor to be present in the country of residence for a minimum number of days each year. The idea behind this is that since you are a resident in our country you need to show up to justify the right of residency.

The presence requirement usually comes with a temporary residency for a number of years. For example, 5 years of temporary residency together with an annual presence of a minimum number of 7 days.

Keep in mind that the presence requirement may entail other obligations on the investor’s part. For instance, if you remain in a country for a predefined period of time, you may become a fiscal resident which means that you may be taxed for income earned internationally. This may not be in the resident’s best financial interest.

Moreover, the presence requirement requires additional funds covering each resident’s travelling and living expenses for a certain period of time. Depending on the number of days required and the number of family members having to fulfill this criterion, this amount could well rise above 10,000€ on a yearly basis.

Finally, at the end of this “trial” period, the applicant may apply for permanent residency, a step that does not require another visit.

3. Investment offering & return on investment

Although investors in residency programmes primarily aim for the residency right and the relevant benefits, a return on their investment along with a possible capital appreciation is a very welcome bonus indeed. The majority of residency programs are linked to real estate investments. It is a win-win proposal both for the offering country and the investor.

Residency programmes helps the local construction industry, while the investor has the opportunity to invest in a property yielding a steady income. When the time comes to sell, the appreciated property value will offer a good resale profit. Exiting from the residency programme is a point that requires extra attention. Not all countries allow exit from the investment at any time. Some require to keep the investment for a minimum predefined period, usually 5 years, while others do not pose any restrictions to this. One simply sells the acquired investment, thus losing the residency right.

There are countries offering a combination of real estate and other forms of investment, like bonds or bank savings or to investment in stocks of local businesses. These schemes are not as popular because the returns vary a lot and it is very difficult to predict the future. Real estate options seem to be far more promising for mid and long-term returns.

4. After sales services & recurring costs for the investor

An equally important factor to consider before selecting a residency programme is the level of fees, taxes, expenses and total expenditure for the duration of the residency period. It is not simple to calculate a specific annual cost from the beginning of the process because it greatly depends on the type and use of the investment. If it is real estate, the decision to keep it vacant or rent it out, makes a great difference. On top of this you need to consider how high property and income taxes are and what is the cost of utility bills on an annual basis.

Of utmost importance on one’s list should be who is going to carry out these tasks. Who will guide the investor every step of the way to turn his dream into reality? Very few residency applicants remember to check beforehand what after sale services are offered.

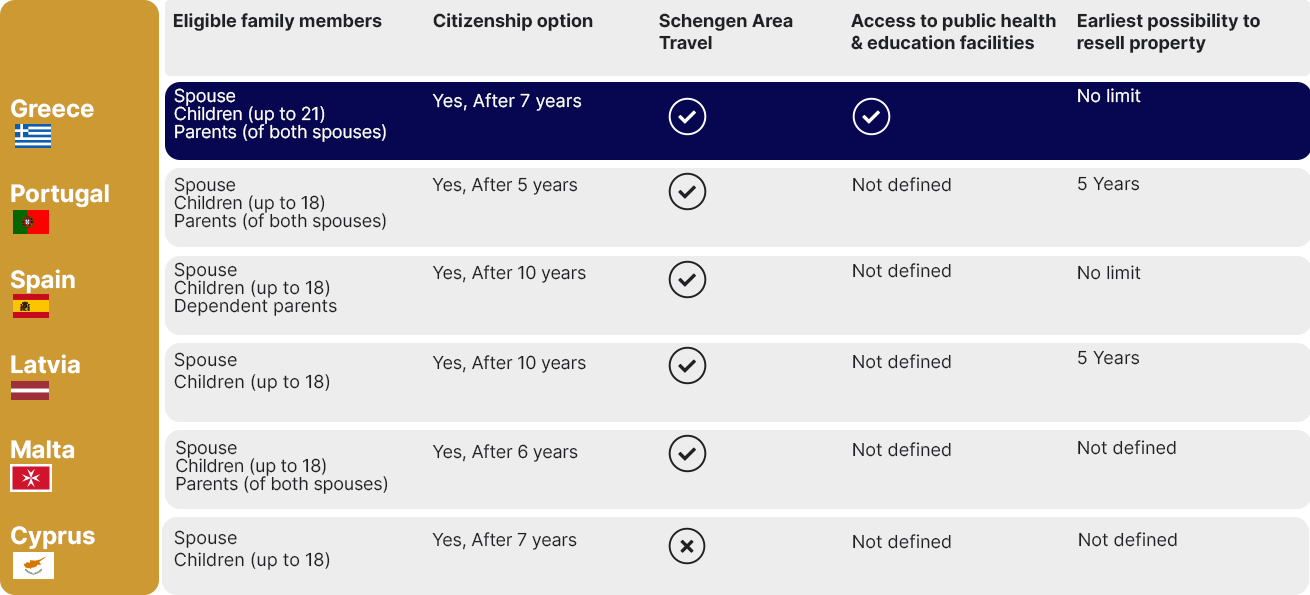

5. Family members that may be included in the programme

The main reason that someone is looking for a residency programme abroad is the safety that goes with it. It is the vital plan B in case the investor needs to flee an unstable country in a hurry. So, the most obvious question while trying to make a selection, refers to family members that may accompany the investor at no extra investment cost.

The most common answer to that question is of course, spouse and children. Here there are different options that should be examined carefully. Children are eligible up to a certain age (at the time of application). Keep in mind that residency for children expires when they reach a certain age. Pay special attention to the “dependent children” definition used by some countries. It is not the same in all countries. For example, an unemployed child 25 years old is considered dependent but a married unemployed child of the same age is not considered dependent.

Some countries offer coverage for the investor’s parents and his in-laws, with or without other criteria like age and financial dependency.

6. Visa-free travel

The second most important reason that someone is looking for a residency programme abroad is freedom of travel. A good residency programme is one with a long list of visa-free countries. The most desirable destination for residency investment is by far Europe. EU or Schengen zone access is number one in investors’ lists. A residency permit in a Schengen zone country means having an entry ticket to 26 countries of this borderless area.

There is no need for the resident to visit any embassy or to spend any money to apply for a visa. He can simply buy a plane ticket and go.

Europe is followed by the United states of America in the list of countries offering residency. Australia is also a popular destination mainly for investors from the Far East.

7. Other secondary, but not less important factors

Although these types of programmes do not target career seekers, some countries offer access to the job market. Some offer free access to the public education and public health systems. There are countries that allow the investor to open as many bank accounts as desired and to register unlimited number of funds. Other countries require from the investor to keep a minimum amount of funds in local banks.

8. The road to citizenship

This is the million dollar piece of information that everyone wants to have. Will the residency lead to citizenship ? When and how ?

The answer is clear: most programmes offer an initial residency status that may eventually and under very strict criteria lead to citizenship eligibility. The time frame to citizenship varies a lot. Depending on the country, it may be 5 or 10 years or more. The conditions vary too. They may require knowledge of the language or to actually live in the country for a minimum period of time before applying.

Citizenship is not an easy target through a residency by investment program.

There are countries who offer fast track citizenship. Such as Cyprus and Malta in Europe and more than 10 countries in the Caribbean region. The prices vary a lot too, starting from 100,000USD in the Caribbean and rising to more than 2 million Euros in Europe.

The above information sums up the basic criteria that anyone who considers participating in any investment by immigration program should read carefully before his/her final decision. Of course, there may be other more subjective criteria, such as proximity to the investment country, processing times, a country’s quality of life, etc.

See below a comparison chart of the most popular European residency programs.

Investment Amount

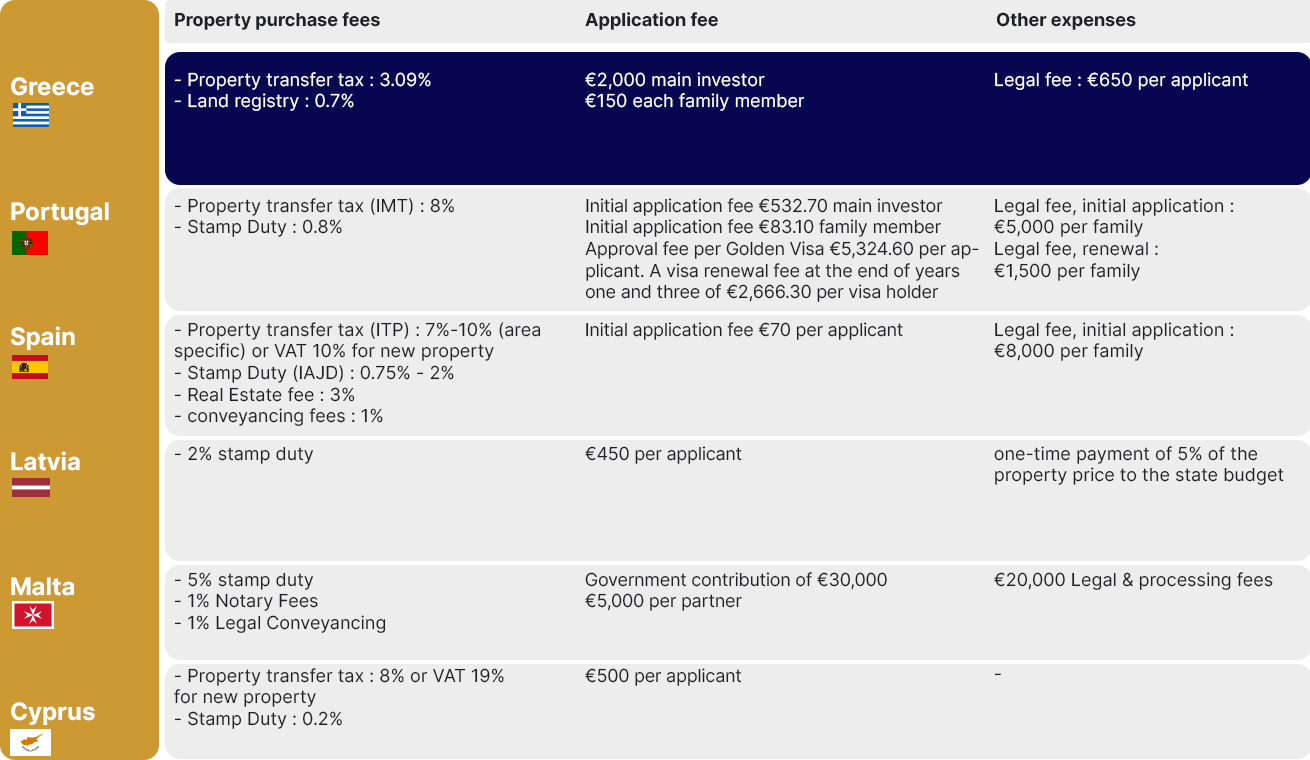

Fees

Initial Residency Status

*Initial Residency Status – Portugal: After 5 years of temporary residency the investor may apply for permanent residency. They need (among other requirements ) to have accommodation ensured, means of subsistence and to have sufficient command of basic Portuguese language.

*Initial Residency Status – Spain: After 5 years of temporary residency the investor may apply for permanent residency.

*Initial Residency Status – Latvia: Applicant must live in Latvia for at least 4 out of the last 5 years after obtaining a Latvia residence permit. He must also pass a Latvian language test and have knowledge of general history of the country and know the National anthem.

Other Criteria

Malta: the applicant must provide evidence that he/she holds an annual income of at least 100,000€ or holds capital of at least 500,000€.

Cyprus: 30,000€ must be deposited in a local bank account. The applicant must provide evidence that he/she holds an annual income ( abroad ) of at least 30,000€ + 5,000€ per child + 8,000€ per dependent parent.

- Investment Amount

- Property Purchase Fees

- Application Fee

- Other Expenses

- Initial Residency Status

- Earliest Renewal

- Residency becomes permanent

- Physical presence requirements

- Eligible family members

- Citizenship option

- Schengen area travel

- Access to public health & education facilities

- Earliest possibility to resell property

-

Greece

-

Greece 250,000€

Greece 250,000€ -

Greece Property transfer tax: 3.09%

Greece Property transfer tax: 3.09%

Land registry: 0.7% -

Greece 2,000€ main investor / 150€ each family member

Greece 2,000€ main investor / 150€ each family member -

Greece Legal fee: 650€

Greece Legal fee: 650€ -

Greece Permanent

Greece Permanent -

Greece 5 years

Greece 5 years -

Greece From day 1

Greece From day 1 -

Greece No

Greece No -

Greece Spouse, children ( up to 21 ) and parents ( of both spouses )

Greece Spouse, children ( up to 21 ) and parents ( of both spouses ) -

Greece Yes, after 7 years

Greece Yes, after 7 years -

Greece Yes

Greece Yes -

Greece Full Access

Greece Full Access -

Greece No limit

Greece No limit

-

-

Portugal

-

Portugal 350,000€

Portugal 350,000€ -

Portugal Property transfer tax (IMT): 8%

Portugal Property transfer tax (IMT): 8%

Stamp duty: 0.8% -

Portugal 532.70€ main investor / 83.10€ each family member.

Portugal 532.70€ main investor / 83.10€ each family member.

Approval fee per Golden Visa: 5,324.6€ per applicant.

A visa renewal fee at the end of year 1 and 3, which is 2,666.30 per visa holder. -

Portugal Legal fee ( initial ): 5,000€ per family

Portugal Legal fee ( initial ): 5,000€ per family

Legal fee ( renewal ): 1,500€ per family -

Portugal Temporary

Portugal Temporary -

Portugal 1st, 3rd & 5th year

Portugal 1st, 3rd & 5th year -

Portugal After 5 years ( under conditions )

Portugal After 5 years ( under conditions ) -

Portugal 7 days per year

Portugal 7 days per year -

Portugal Spouse, children ( up to 18 ) and parents ( of both spouses )

Portugal Spouse, children ( up to 18 ) and parents ( of both spouses ) -

Portugal Yes, after 5 years

Portugal Yes, after 5 years -

Portugal Yes

Portugal Yes -

Portugal Not defined

Portugal Not defined -

Portugal 5 years

Portugal 5 years

-

-

Spain

-

Spain 500,000€

Spain 500,000€ -

Spain Property transfer tax (ITP): 7-10% (area specific) or VAT 10% for new property

Spain Property transfer tax (ITP): 7-10% (area specific) or VAT 10% for new property

Stamp duty (IAJD): 0.75%-2%

Real estate fee: 3%

Legal conveyancing fees: 1% -

Spain Initial appplication fee: 70€ per applicant

Spain Initial appplication fee: 70€ per applicant -

Spain Legal fee ( initial ): 8,000€ per family

Spain Legal fee ( initial ): 8,000€ per family -

Spain Temporary

Spain Temporary -

Spain 1st, 3rd and 5th year

Spain 1st, 3rd and 5th year -

Spain After 5 years ( under conditions )

Spain After 5 years ( under conditions ) -

Spain 7 days per year

Spain 7 days per year -

Spain Spouse, children ( up to 18 ) and parents ( of both spouses )

Spain Spouse, children ( up to 18 ) and parents ( of both spouses ) -

Spain Yes, after 10 years

Spain Yes, after 10 years -

Spain Yes

Spain Yes -

Spain Not defined

Spain Not defined -

Spain No limit

Spain No limit

-

-

Latvia

-

Latvia 250,000€

Latvia 250,000€ -

Latvia Stamp duty: 2%

Latvia Stamp duty: 2% -

Latvia 450€ per applicant

Latvia 450€ per applicant -

Latvia One-time payment of 5% on property price to the State budget

Latvia One-time payment of 5% on property price to the State budget -

Latvia Temporary

Latvia Temporary -

Latvia Every year

Latvia Every year -

Latvia After 5 years ( under conditions )

Latvia After 5 years ( under conditions ) -

Latvia 1 day per year

Latvia 1 day per year -

Latvia Spouse, children ( up to 18 )

Latvia Spouse, children ( up to 18 ) -

Latvia Yes, after 10 years

Latvia Yes, after 10 years -

Latvia Yes

Latvia Yes -

Latvia Not defined

Latvia Not defined -

Latvia 5 years

Latvia 5 years

-

-

Malta

-

Malta 320,000€ (Malta) or 270,000€ (Gozo) AND the purchase of 250,000€ of govermental bonds

Malta 320,000€ (Malta) or 270,000€ (Gozo) AND the purchase of 250,000€ of govermental bonds -

Malta Stamp duty: 5%

Malta Stamp duty: 5%

Notary fees: 1%

Legal conveyancing fees: 1% -

Malta Goverment contribution: 30,000€ / 5,000€ per partner

Malta Goverment contribution: 30,000€ / 5,000€ per partner -

Malta 20,000€ Legal & processing fees

Malta 20,000€ Legal & processing fees -

Malta Permanent

Malta Permanent -

Malta 5 years

Malta 5 years -

Malta After 5 months

Malta After 5 months -

Malta Not defined

Malta Not defined -

Malta Spouse, children ( up to 18 ) and parents ( of both spouses )

Malta Spouse, children ( up to 18 ) and parents ( of both spouses ) -

Malta Yes, after 6 years

Malta Yes, after 6 years -

Malta Yes

Malta Yes -

Malta Not defined

Malta Not defined -

Malta Not defined

Malta Not defined

-

-

Cyprus

-

Cyprus 300,000€

Cyprus 300,000€ -

Cyprus Property transfer tax (ITP): 8% or VAT 19% for new property

Cyprus Property transfer tax (ITP): 8% or VAT 19% for new property

Stamp duty: 0.2% -

Cyprus 500€ per applicant

Cyprus 500€ per applicant -

Cyprus -

Cyprus - -

Cyprus Permanent

Cyprus Permanent -

Cyprus 5 years

Cyprus 5 years -

Cyprus After 9 months

Cyprus After 9 months -

Cyprus No

Cyprus No -

Cyprus Spouse, children ( up to 18 )

Cyprus Spouse, children ( up to 18 ) -

Cyprus Yes, after 7 years

Cyprus Yes, after 7 years -

Cyprus No

Cyprus No -

Cyprus Not defined

Cyprus Not defined -

Cyprus Not defined

Cyprus Not defined

-

Initial Residency Status – Portugal: After 5 years of temporary residency the investor may apply for permanent residency. They need (among other requirements ) to have accommodation ensured, means of subsistence and to have sufficient command of basic Portuguese language.

Initial Residency Status – Spain: After 5 years of temporary residency the investor may apply for permanent residency.

Initial Residency Status – Latvia: Applicant must live in Latvia for at least 4 out of the last 5 years after obtaining a Latvia residence permit. He must also pass a Latvian language test and have knowledge of general history of the country and know the National anthem.

Malta: the applicant must provide evidence that he/she holds an annual income of at least 100,000€ or holds capital of at least 500,000€.

Cyprus: 30,000€ must be deposited in a local bank account. The applicant must provide evidence that he/she holds an annual income ( abroad ) of at least 30,000€ + 5,000€ per child + 8,000€ per dependent parent.